Awe-Inspiring Examples Of Info About How To Choose Depreciation Method

Praised for its simplicity, it works by reducing the value of the asset by the same amount every year for.

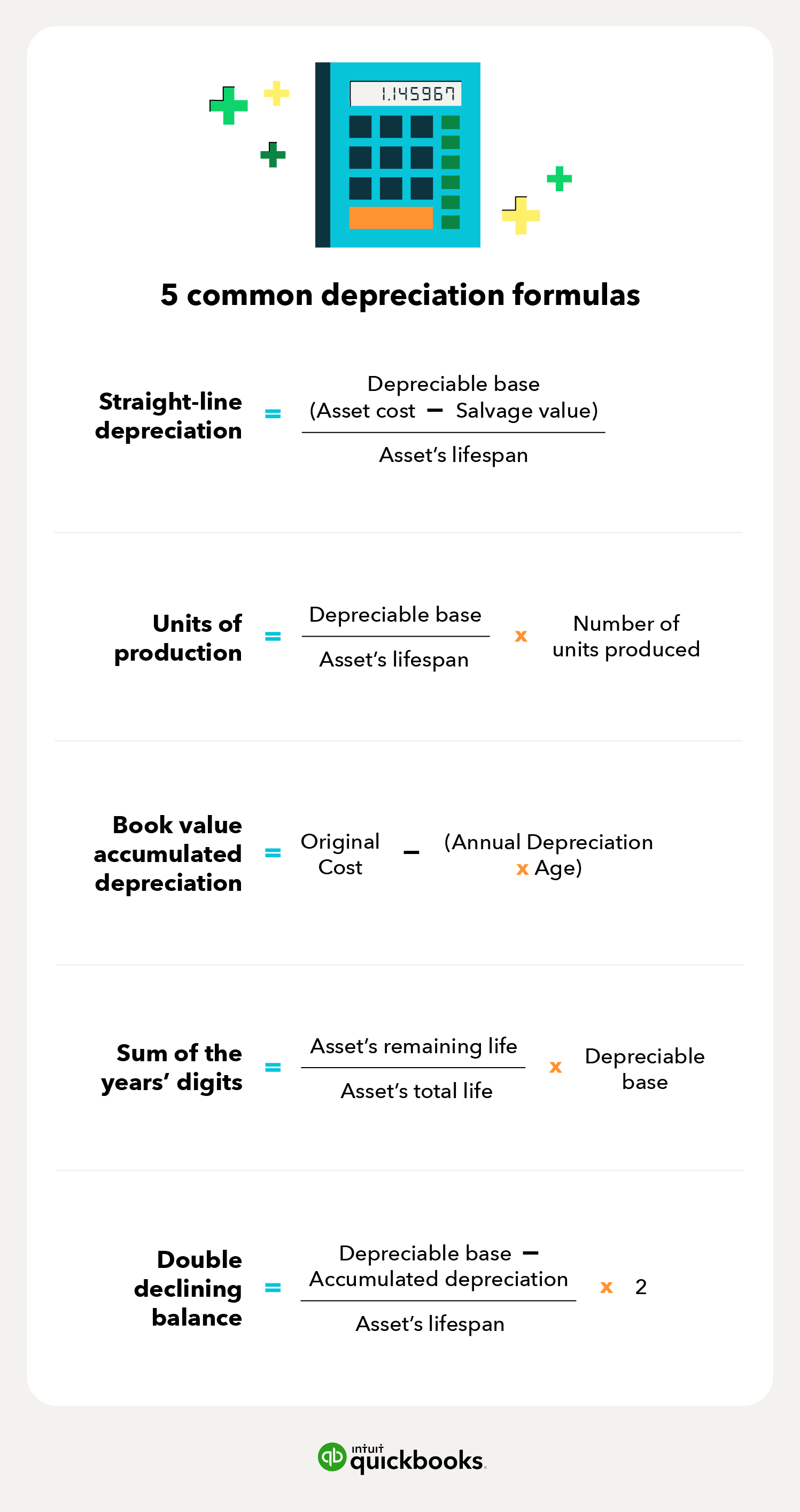

How to choose depreciation method. Hence, we need to understand the impact of each methodology re: Other methods of depreciation rely on estimation, while this relies on data. How to calculate depreciation formula?

Depreciation method = alternate method (alt) the macrs convention , year of depreciation , recovery period , and depreciable basis should fill in automatically. This limit is reduced by the amount by which the cost of. Subtract the asset's salvage value from its total cost to determine what is.

When you use a nonrecovery method, enter the life in life or class life in the depreciation (4562) screen; How do you know which depreciation method to use? Under the general depreciation system (gds) method, most.

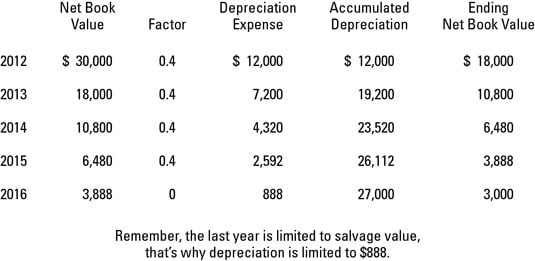

How to calculate accumulated depreciation formula. Section 179 deduction dollar limits. If your asset is a machinery or plant that works best during the initial years of its useful life and.

For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. Units of production depreciation = (number of units produced / life in number of. Assume a business buys a machine for inr 1crore with a useful life of 25 years and a salvage.

You should choose depreciation methods depending on how you choose to use the asset. If you want to make use of the units of production depreciation method, you can try the following formula:

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)